capital gains tax changes uk

Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate. In other words the tax only becomes.

Capital Gains Tax Commentary Gov Uk

The UK government introduced non-resident capital gains tax NRCGT which applies to all non-UK residents including individuals trusts and companies.

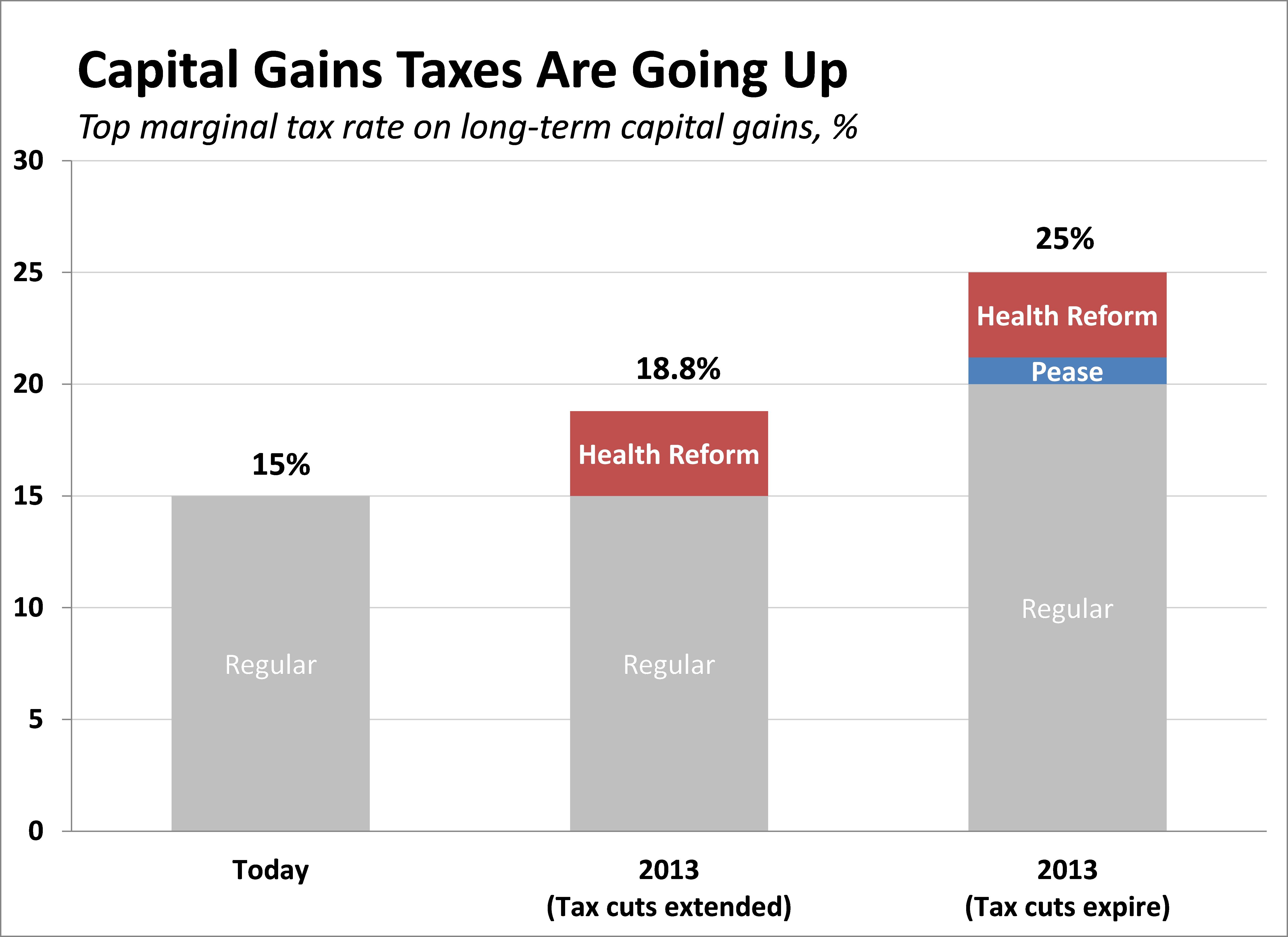

. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. As the name might imply Capital Gains Tax CGT is paid on the gain on the sale of an asset that has risen in value. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget.

But while ordinary workers pay income tax and national insurance costing 32 of income for someone on the basic rate and 47 for those at the very top capital gains tax. The annual exempt amount for individuals and personal representatives remains 12300 for 202223 and the annual exempt amount for most trustees also remains. You previously had 30 days to report any gains.

The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. What were the Capital Gains Tax changes. Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property.

Landlords could be affected by extra changes being proposed to capital gains tax. Under the new CGT rules from April 2020 the CGT at. Capital Gains Tax UK changes are coming.

The change to capital gains tax went live when the budget was announced on 27th October 2021 and relates to property sales. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property. Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts.

Taxes united-kingdom capital-gains-tax capital-gain Share Improve this question. Under the current CGT rules CGT at 28 on a disposal would be 29173 for each owner due by 31 January 2021. CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in.

In the UK gains made by companies fall under the scope of corporation tax rather than capital gains tax. Once again no change to CGT rates. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some.

HM Revenue Customs. UK residents who dispose of a UK residential property that is not their main. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

There may well be some form of change to Capital Gains Tax rates but the annual exemptions will stay at 12300 for individuals and 6150 for most trusts. What are the changes. 10 on assets 18 on property.

For the 2020 to 2021 tax year the allowance is 12300 which leaves 300 to pay tax on. The Office of Tax Simplification OTS has made a range of additional suggestions to the. Since 6 April 2020 there have been changes to how customers declare and pay Capital Gains Tax.

The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income. 20 on assets and property.

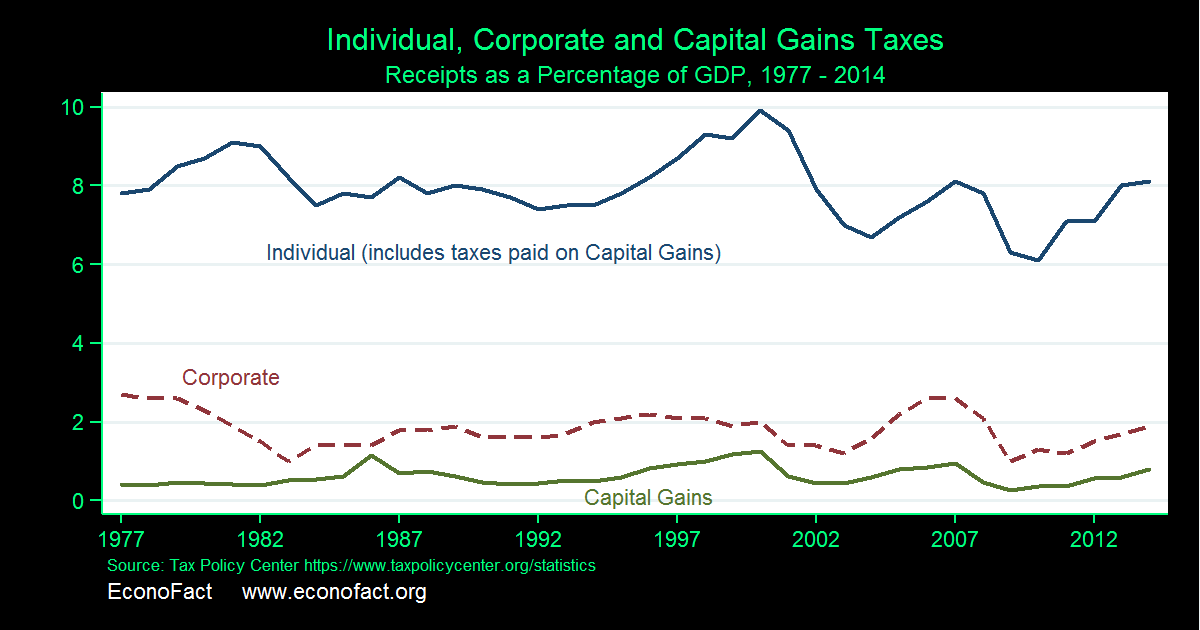

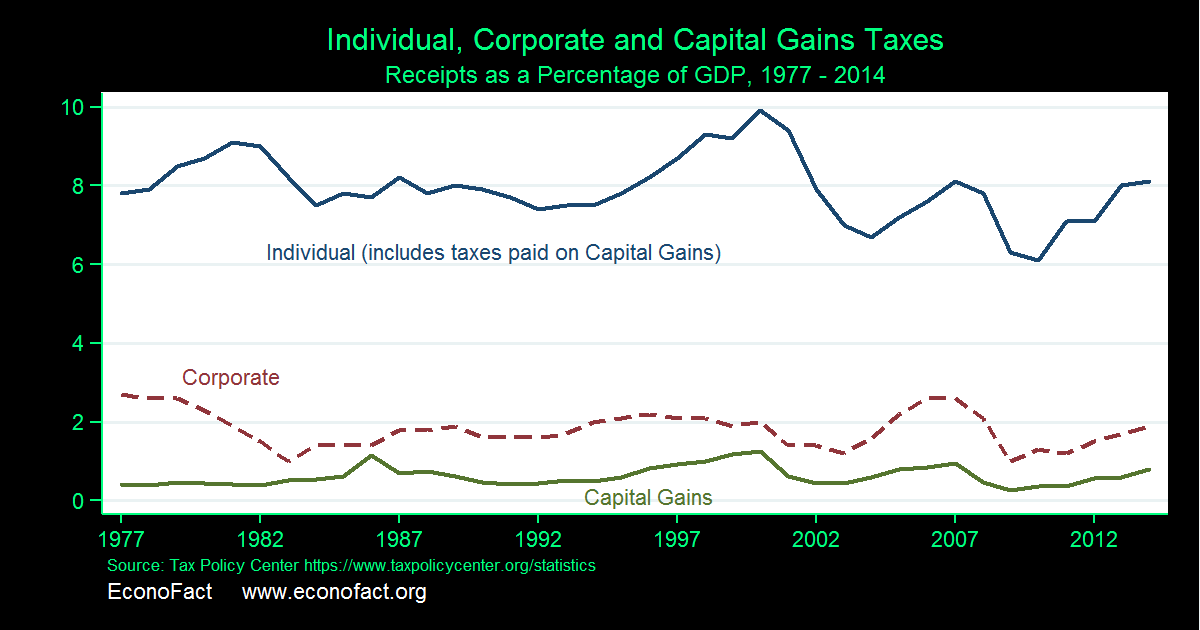

Capital gains tax reporting extended. In 201718 total capital gains tax receipts were 83 billion from.

Capital Gains Tax What Is It When Do You Pay It

Financial Figures You Should Monitor Tax Accountant Accounting Capital Gains Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Taxes Are Going Up Tax Policy Center

How Are Dividends Taxed Overview 2021 Tax Rates Examples

9 Expat Friendly Countries With No Capital Gains Taxes

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

2022 Capital Gains Tax Rates In Europe Tax Foundation

Contacts Accountants Hove Brighton Capital Gains Tax Tax Advisor Brighton

The Capital Gains Tax And Inflation Econofact

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

What Is Capital Gains Tax And When Are You Exempt Thestreet

How To Tax Capital Without Hurting Investment The Economist

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Difference Between Income Tax And Capital Gains Tax Difference Between

Reap The Benefits Of Tax Loss Harvesting To Lower Your Tax Bill Investing Income Tax Preparation Capital Gains Tax